Q4 2021 Market Insights

As the new year unfolds, we find ourselves reflecting on the last 12 months while looking forward to the potential of 2022. 2021 was filled with change and challenges but it also brought progress and opportunity. Financial markets thwarted headwinds from inflation, supply constraints, and Covid-19 variants to finish the year near new record highs. At home in Jackson, it was another busy and record-setting year in many ways. For investors, thoughtful planning and a disciplined approach are key to navigating the markets in the new year as global growth transitions from a pandemic-driven economic cycle.

Around Town

After a mild fall, winter is finally in full swing here in Jackson. Storm totals over the last two weeks are nearing 100” in the upper elevations. This has made for some incredible skiing and riding, but created dangerous and unstable conditions in the backcountry. In 2021, the backcountry was a popular playground. Teton County Search & Rescue matched their busiest season on record with 105 calls for service. Grand Teton and Yellowstone National Park set visitation records month after month. Yellowstone had 1 million visitors in July alone. Real estate continued the record-setting trend. Despite low inventory, real estate dollar volume increased 21% from 2020 to $2.97 billion. With home values and rents on the rise, multiple affordable housing projects are underway. Also making headlines was renowned Grizzly 399 and her cubs, who ventured as far south as Snake River Canyon before passing through downtown Jackson on their way north for the winter. Snow King Mountain put the finishing touches on its new gondola which replaced the town hill’s Summit Lift. While it was bittersweet to see the iconic chair retired, it’s exciting to watch the next generation of skiers and riders enjoy the mountain in new ways.

Market Recap

2021 was another unprecedented year for the financial markets. Despite volatility, risk assets (equities) continued to climb supported by historic earnings growth and robust economic activity. The year, however, was not without uncertainty as worries arose in tandem with upbeat equity performance. During the first quarter markets were challenged by the meme stock craze as retail investors piled into select securities. Continued waves of Covid tested the service and travel industry, stressed healthcare systems, and delayed many employers return-to-office plans. Robust consumer demand fueled economic growth but it also contributed to supply chain bottlenecks as prices for goods rose at the fastest pace in decades. These inflationary pressures rattled bond markets and led central banks around the globe to shift to a less accommodative monetary policy. Despite the headwinds, U.S. stocks outpaced global equities by the biggest margin in two decades as the S&P 500 finished up 26.9% for the year.

Looking Ahead

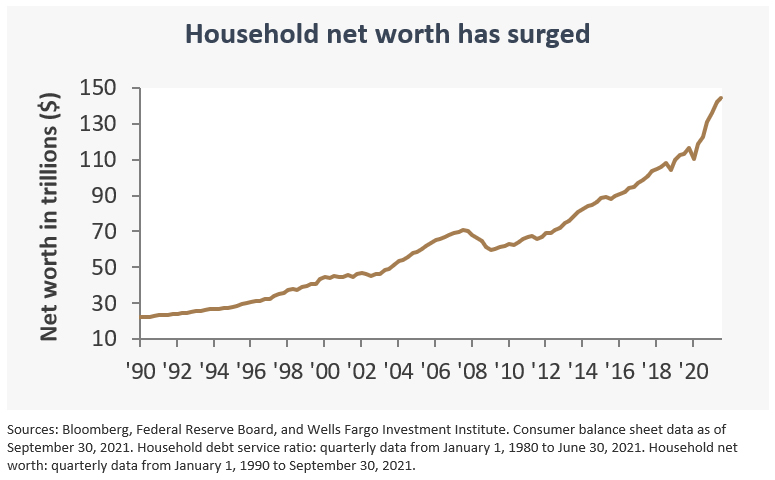

As 2022 gets underway investors could find themselves at a crossroads. Markets have seen three strong years of gains and many question whether further asset price appreciation will prevail or if equities will retreat from recent highs. Now more than ever, investors must separate market noise from key information. As a whole, the economy continues to perform well. Jobs are plentiful, corporate earnings are forecasted to remain strong, and consumer savings and income have expanded considerably. The U.S. and global economies are positioned for continued growth; however, growth is likely to slow to a more sustainable pace. Inflation is expected to remain above its long-term average but it should ease as supply chains catch up to demand and disruptions from Covid-19 decrease. Rising interest rates also remain front-of-mind. Central banks domestically and globally are expected to raise rates and remove many pandemic-related stimulus to help fight inflation. Outside the U.S., vaccination coverage should help international economies during the second half of the year, but weighing costs of higher fuel prices could slow Europe and Asia’s pace of growth. As early-cycle dynamics evolve into mid-cycle drivers, the U.S. is likely to be one of the main forces behind global economic growth in 2022.

Portfolio Insights

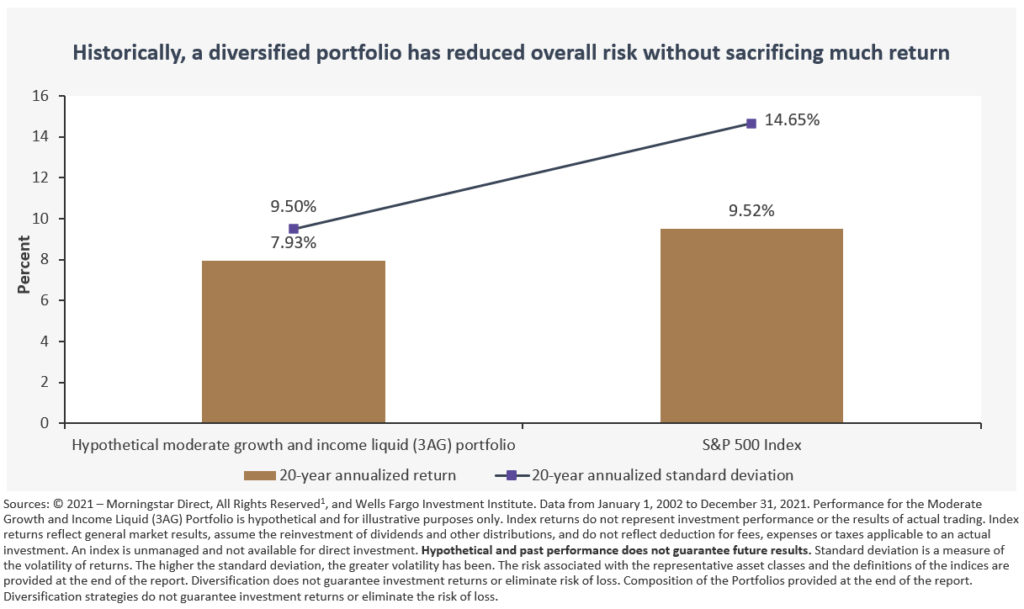

Investors should remain disciplined and focused on their long-term investment strategy as the economy transitions. Diversification is key as unsynchronized global growth is expected. The market could be positioned for positive equity returns in 2022 based on higher corporate earnings forecasts; however, we recommend seeking higher-quality equities as the economic cycle matures and prefer a greater balance of cyclical over growth stocks. We also recommend being mindful of cash positions as inflation remains high. During periods of high inflation, commodities, cyclicals, and U.S. mid-caps tend to be effective hedges. Volatility is also likely to persist, especially as the Fed begins to raise interest rates. To play defense and mitigate downside risk, investors could add suitable duration fixed income positions to increase diversification. The appropriate nature of these strategies is unique to each investors’ unique financial situation and should be examined on a case by case basis.

We wish you and your family health and happiness in the coming year. Sincerely,

The Wind River Capital Management Team