Q1 2023 Market Insights

Market Transitions Take Time

It’s springtime in Jackson, which means in many ways it still feels like winter. For us skiers and snowboarders, it was a season unlike any other filled with ample cold, snowy powder days. The tradeoff however meant minimal sunshine and lots of snow shoveling. Although it’s bittersweet when the chairlifts stop spinning, many of us are ready for warmer days and the seasons to change, just as us investors are ready for a transition in markets. For the first quarter, major indexes finished up, but volatility and inflation remained persistent as the Federal Reserve continued raising interest rates and economic indicators showed signs of slowing growth. Looking ahead, we continue to advise investors to remain disciplined and focused on portfolio positioning instead of trying to predict movements as markets continue to transition.

Around town

Snow followed by more snow; that’s been the story this winter. Jackson Hole Mountain Resort reported a record breaking 595” for the 2022-23 season, setting a new record for snow received in Rendezvous Bowl. Grand Targhee Resort also reported a record-breaking 576”. Snowpack in terms of water content is currently around 120% of average in the Upper Snake River Basin and the snow depth in Town of Jackson is the deepest it’s ever been. Town received 105” through the end of March, which equates to shoveling or plowing almost nine feet of snow (this is 148% of the long-term average of 71”). All the snow at lower elevations might delay the highly coveted shed antler hunt on the National Elk Refuge and the first grizzly bear sighting occurred in Grand Teton National Park on March 22nd.

Market Recap

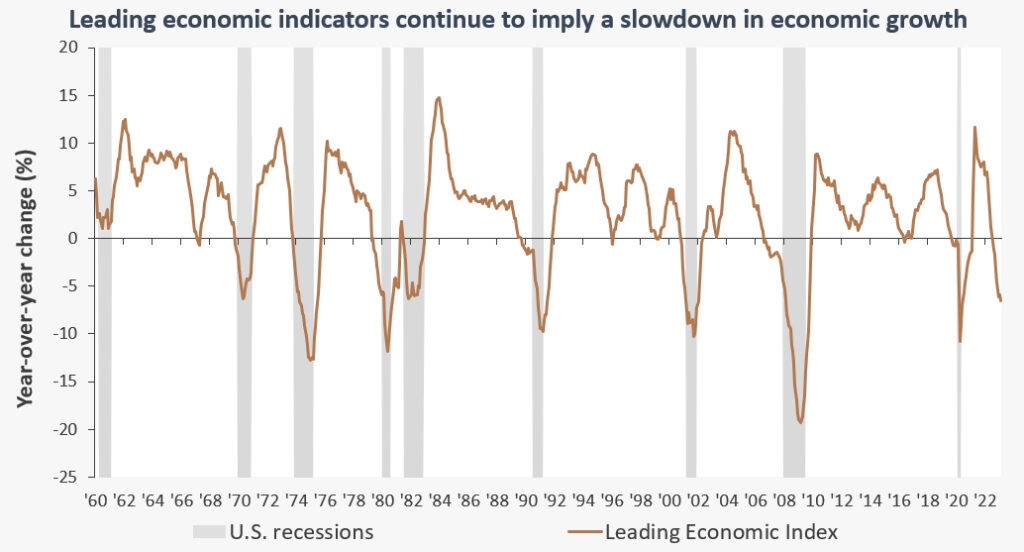

In a first quarter full of unexpected twists, the S&P finished up almost 7% at 4109.31. The Nasdaq posted strong gains as well and the Dow Jones was relatively flat(1). Investors continue to grapple with a focused Federal Reserve (Fed) that is tightening monetary policy at its fastest pace since 1981 and stubborn inflation. Concerns over the health of the economy led to a quarter full of market swings and unforeseen events like those that plagued the financial sector with the collapse of two U.S. Banks and the capitulation of Credit Suisse. Stress on banking institutions led to some of the largest swings in U.S. Treasury yields since The Great Recession and commercial real estate had its worst quarter since 2008(2). The U.S. economy however remains resilient as unemployment remains low, but leading economic indicators are beginning to reflect a slow to modest contraction in activity(3).

If history is any guide, as you approach the end of economic growth cycles, investors are often fraught with conflicting messages that build gradually and then create sudden, startling events. The first quarter of 2023 was filled with many such events: bank failures requiring government action; investors flocking to short-duration fixed income (money markets and treasuries) causing yields to quickly fall; and money supply growth falling into negative territory(4). This undoubtedly tests investors patience, but the good news is with every unprecedented event, we’re a little closer to the start of a new recovery and bull market. However, the transition between economic cycles takes time. But how much time is the question no one knows exactly how to answer. Conditions continue to deteriorate across many facets of the economy, including manufacturing, services and credit sectors. Most of the data points to a slowdown, which would then help suppress inflation and lead to a pause in the Fed hiking rates. This could push the U.S. into a recession in the latter half of 2023, but nevertheless, instead of trying to predict the next recession, we believe investors should focus more on portfolio positioning.

Portfolio Insights

Bear markets can be long and exhausting, but they can also present opportunities for patient and practiced investors. We believe investors can use the transition time between economic cycles to their benefit by focusing on asset allocation and revisiting their long-term investment objectives. For investors seeking income, bond yields continue to look attractive. Implementing a barbell strategy still makes sense (combing short-term with longer duration fixed income assets) and can help investors take advantage of higher yields while reducing downside risk. For equity investors, quality is important, especially as corporate earnings are anticipated to deteriorate. The continued volatility also presents opportunities for investors to increase positioning in more attractive assets – for example, investors can use market rallies to add more defensive positions, such as securities of companies that pay consistent dividends and have strong balance sheets. We believe focusing less on market predictions and more on market positioning is better for investors over the long-term.

We invite you to call us if you would like to talk more about the challenging market cycle we continue to work our way through. Happy spring, and here’s to more warm, sunny days!

Sincerely,

The Wind River Capital Management Team

**The report herein is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice. Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

-

Stocks Close Higher in Last Session of Turbulent Quarter https://www.wsj.com/articles/global-stocks-markets-dow-update-03-31-2023-2eafbb02

-

Bond market swings are wildest since ’08 https://www.axios.com/2023/03/22/treasury-bond-market-volatility-bofa-move-index-fed-meeting

-

Source: When Things Fall Apart, State of the Markets. Wells Fargo Investment Institute. Darrell Cronk. CAR-0423-01331

-

Source: So far, so Good. Wells Fargo Investment Institute. CAR-0323-04506

-

Chart 1: Q2 2023 Market Chars. Turning data into Knowledge. Sources: Bloomberg and Wells Fargo Investment Institute. Monthly data from January 1, 1960 to February 28, 2023. The Conference Board Leading Economic Index® (LEI) is a composite average of 10 leading indicators in the U.S. It is one of the key elements in the Conference Board’s analytic system, which is designed to signal peaks and troughs in the business cycle.