Q2 2023 Market Insights

Focus & Fortitude Reward Investors

After a long, wet spring, summer has finally arrived in Jackson. The valley is as green as ever, the lakes and rivers are full, and the hiking and biking is as good as it gets. We had to earn our sunshine after a record-breaking snow year. On April 8th we finally snapped a 157-day streak of temperatures below 50 degrees (the all-time continuous sub-50-degree record is 162 days in 1935/36). Patience was the name of the game, and over the last few weeks we’ve been rewarded with ample sunshine. Investors were rewarded as well for their patience as major market indexes finished in positive territory for the first half of 2023. Investors who remained disciplined and focused on their long-term strategies for the first half of the year saw the S&P 500 rise 15.9% and the Nasdaq surge 31.7%. As we move into the second half of the year, we recommend investors maintain a long-term focus and be mindful of portfolio positioning as market uncertainty is likely to remain until interest rates stabilize.

Around town

With Jackson Lake 90% full, our big winter was great for our lakes and rivers but tough on our roads. Public works and WYDOT crews worked tirelessly to fix massive potholes throughout the valley. Spring also brought another year of property tax spikes as real estate prices continued to rise – the average single-family home price reached a new record high. El Nino made an early appearance and brought cooler temperatures and above average moisture as Teton County saw rainfall amounts around 190% of average. Despite the variable weather, the National Elk Refuge antler auction raised 60% more than a normal year and the Northern Lights graced the skies over Jackson. Farmer’s markets and live music kicked back into gear and tourists in Yellowstone caused havoc harassing Bison and walking across the Grand Prismatic Spring. The iconic Teton skyline also changed forever as giant rockfall fell from the Grand’s east ridge.

Market Recap

At the start of the second quarter investors were on high alert for a recession and thinking the Federal Reserve could soon start cutting interest rates, but by the end of the quarter the economy showed resilience, inflation remained sticky, and more rate hikes seemed likely. Concerns over the debt ceiling didn’t faze markets as the S&P 500 rose 8.3% posting its biggest quarterly advance since the fourth quarter of 2021. Fueled by the artificial intelligence frenzy, the Nasdaq jumped 12.8% posting back-to-back quarters of gains and its best first half of the year since 1983(1). For equities, market breadth remained narrow as mega-cap stocks accounted for most of the gains. It was a mixed quarter for bonds as investors soon realized rates weren’t likely to subside anytime soon. However, higher yields are making many fixed income assets more attractive than they’ve been in years(2)

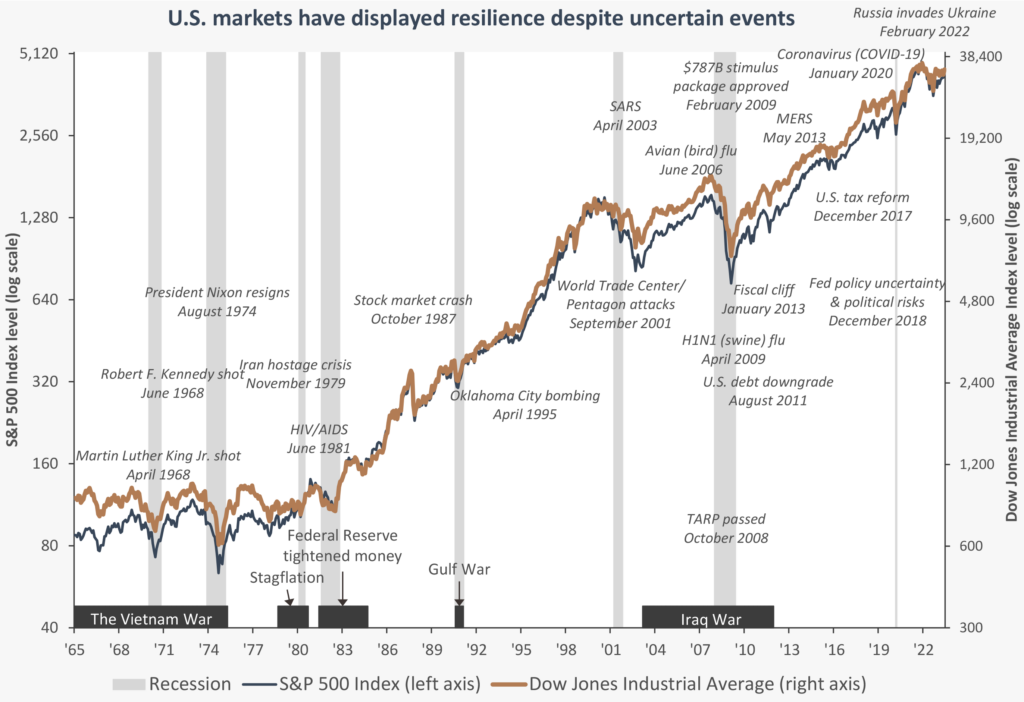

Historically, economic cycles have followed a natural order. Rising inflation causes the Fed to raise rates, which then creates conditions that lead to a bear market, and next a recession. To get the economy out of a recession the Fed cuts rates which feeds a bull market environment and an eventual economic recovery. This sequence of events is again at play as the longest anticipated recession in recent memory still weighs on investors’ minds. Mixed economic data is beginning to show signs of a slowdown, but pockets of the labor market remain strong. However, employment is typically one of the last pillars to fall leading into a recession. The good news is recessions help lower inflation, and leading economic indicators are pointing to a short, moderate recession. The even better news is bear markets have created some of the best opportunities for patient investors to grow capital(4).

Portfolio Insights

While equity markets are positive year-to-date, uncertainty for the back-half of 2023 still exists as the Fed continues to fight inflation. Portfolio positioning, with a side of perseverance, are key elements to navigating said uncertainty and taking advantage of market opportunities. We favor quality equity positions as corporate earnings continue to weaken. Investors may also consider taking advantage of the recent rally to reposition to more attractive assets in favorable sectors, such as energy, health care and materials. A barbell strategy may still make sense for fixed income investors (combining short-term with longer duration fixed income assets). Maintaining credit quality and sticking with investment grade fixed income can also be important when positioning for an economic slowdown. In light of the first half performance, we also feel it’s a good time for investors to reassess their cash positions.

We invite you to call us if you would like to talk more about the dynamic market we continue to navigate. We wish you a warm, sunny summer full of adventures and time with family and friends!

Sincerely,

The Wind River Capital Management Team

**The report herein is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice. Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

-

Q2 2023 Market Outlook. Morningstar. https://www.morningstar.com/markets/q2-2023-review-market-outlook

-

Stock Funds Rally to 12.4% gain for 2023 so far. Wall Street Journal https://www.wsj.com/articles/stock-funds-rally-12-4-gain-2023-cbe84472

-

Chart 1: Q3 2023 Market Charts. Turning Data into Knowledge. Wells Fargo Investment Institute and Bloomberg. Monthly data from January 1, 1965 to June 30, 2023. Shaded areas represent recessions. TARP = Troubled Asset Relief Program. Fed = Federal Reserve. SARS = Severe Acute Respiratory Syndrome. MERS = Middle East Respiratory Syndrome. For illustrative purposes only. A price index is not a total return index and does not include the reinvestment of dividends. The S&P 500 Index is a market capitalization-weighted index composed of 500 stocks generally considered representative of the U.S. stock market. The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. Index returns do not represent investment performance or the results of actual trading. Index returns represent general market results and do not reflect deduction for fees, expenses or taxes applicable to an actual investment. An index is unmanaged and not available for direct investment. Past performance is no guarantee of future results. There is no certainty that U.S. markets will continue to show resilience despite crisis events. Investing in stocks involves risk and their returns and risk levels can vary depending on prevailing market and economic conditions. There is no guarantee equity markets will perform similarly during other periods of uncertainty. All investing involves risk including the possible loss of principal.

-

Source: 2023 Mid Year Outlook. Wells Fargo Investment Institute. Darrell Cronk. CAR-0623-00389