Q4 2022 Market Insights

Remaining Balanced & Ready

We hope you enjoyed a wonderful holiday with family and friends and are having a rewarding start to the new year. For us skiers and snowboarders, winter arrived early as snow began piling up around the valley at the start of November. Since then, the pace of accumulation has remained steady, just like the velocity of interest rate increases from the Federal Reserve. As investors, we are glad to close the books on 2022. Both equity and bond markets posted negative returns as inflation remained persistent and the U.S. economy battled the fastest pace of real rate tightening in modern history. Looking ahead, we believe investors should remain disciplined and balanced in their capital allocations, and ready for market shifts if inflation continues to wane and interest rates stabilize.

Around Town

After a low snow year last winter and a dry spring, it’s been a relief seeing snow fall from the sky. With 270+ inches at the Rendezvous Bowl Plot and 54+ inches in the town of Jackson, to-date snow totals are already around 70% of an average winter season. This is great news for our rivers and lakes, but it’s been hard on our short-staffed Public Works department. The Jackson Hole real estate market experienced a big shift as year-end dollar volume was down almost 50% from 2021, and the Astoria Bridge remains closed after a semitruck damaged the bridge. All 15 SPET measures passed in the recent election, search and rescue had its busiest season on record, and visitation numbers across the valley dropped to pre-pandemic levels.

Market Recap

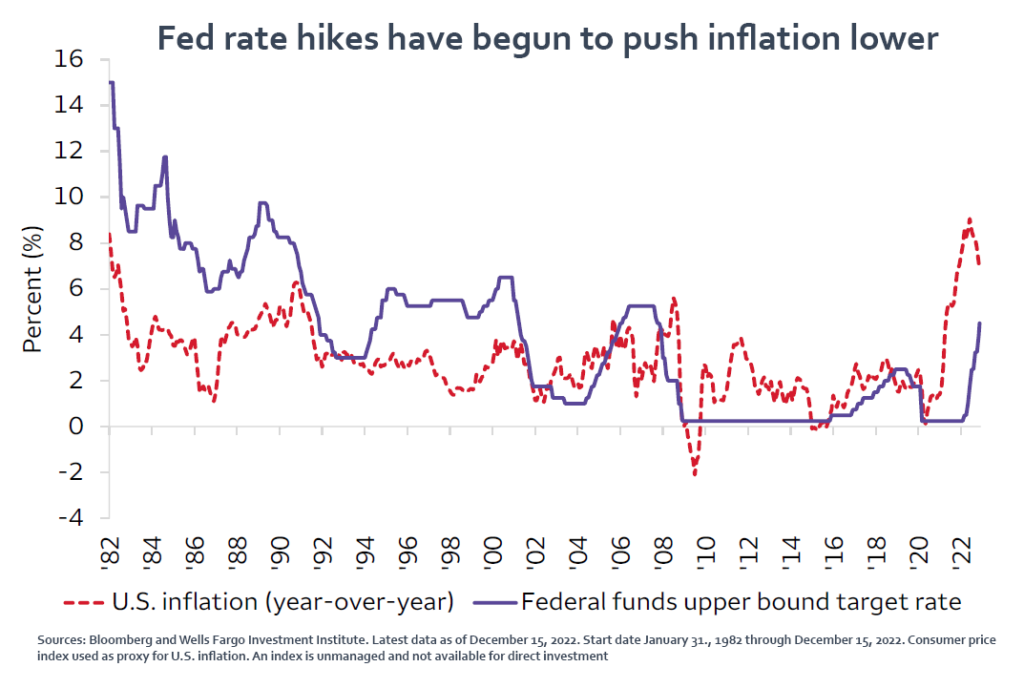

While not unusual for equities to post difficult years, the bond market saw its second year in a row of negative returns, a feat not seen since 1958-59. The U.S. Aggregate Bond Index(1), which tracks U.S. Investment grade debt, fell around -13% in 2022. The S&P 500 tried to stage a year-end recovery with a strong October and November, but rate hikes and robust wage growth pressured the index to finish down -19.4% for the year(2). Inflation, which peaked in June at 9.1%, coupled by a hawkish federal reserve continued to drive volatility in markets and weigh on investor sentiment. Pandemic-era standout equities such as technology stocks experienced large losses as valuations fell from all-time highs. Geopolitical concerns and unpredictable economic data also kept markets on edge.

What do the markets have in store for 2023? Many on Wall Street are expecting a slowdown in global economic growth, and a possible U.S. recession(3). The Fed is also likely to slow its pace of rate hikes, helping to stabilize interest rates and yields. Inflation is also expected to moderate; however, consumer spending is likely to fall, and the housing market is projected to remain weak. Corporate earnings could also struggle in early 2023 as consumers trade spending for savings(4). As the economy transitions, markets will be challenged. But, the good news for investors is bear markets are ultimately a function of price and time, and both could run their course in 2023 if inflation continues its downward trajectory.

Portfolio Insights

Periods when equity and bond markets experience negative returns concurrently have been historically unusual. The past two years have called into question the role of diversifiers such as bonds. While the traditional 60/40 blend (60% equities / 40% bonds) had one of its worst years next to 2008, historically negative years are followed by strong performance, and diversified portfolios like this are known for mitigating volatility over time(5). For investors seeking income, long-term yields tend to peak before the Fed finishes raising rates, and implementing a barbell strategy (combing short-term with longer duration fixed income assets) can help investors take advantage of higher yields while reducing downside risk. For equity investors, stick with quality and stay defensive with positioning. Over the first two quarters of 2023, investors should have more clarity regarding a credible pivot from the Fed. If the market receives a “risk-on” signal, investors that maintain balanced portfolios and are ready to make tactical updates could potentially benefit as the economy mends and price-to-earnings multiples expand.

We wish you and your family a wonderful new year.

Sincerely,

The Wind River Capital Management Team

**The report herein is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice. Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

-

The Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market

-

Source: Stocks fall to end Wall Street’s worst year since 2008, S&P 500 finishes 2022 down nearly 20% https://www.cnbc.com/2022/12/29/stock-market-futures-open-to-close-news.html

-

Source: Q1 2023 Market Charts: Turning Data into Knowledge. 2023 Wells Fargo Investment Institute. All rights reserved. CAR-1222-02195

-

Long-term perspective on markets and economies. 2023 Global Markets Outlook. Capital Group Copyright 2023

-

Wells Fargo Investment Institute. Weekly Guidance January 17, 2023. CAR-0123-01864. Wells Fargo Market Charts. First Quarter 2023. Turning Data into Knowledge.