Q3 2023 Market Insights

Interest Rates Remain Top of Mind

As usual, summer seemed to fly by here in Jackson. Now there’s snow in the mountains and the mornings are cold and the air is crisp. The change in seasons always seems to surprise us, even though we know it’s coming. The same can be said for the markets when the Federal Reserve is raising interest rates. If history is our guide, tightening financial conditions and interest rate uncertainty often leads to stock market volatility. This held true in the third quarter as investor sentiment began to shift as the Federal Reserve hinted at holding interest rates higher for longer. Like a garden wilting from the first fall frost, Fed Chair Jerome Powell’s words sent a solemn signal to markets leading to a retraction across all three major indexes. The Dow finished the quarter down 2.7% and the S&P 500 fell 3.7%, but both remained in positive territory for the year. The change in market conditions is inevitable, just like the change in seasons. With new challenges come new opportunities, and for investors remaining disciplined and mindful of portfolio positioning is a great way to make the most of market uncertainty.

Around town

Smokey skies and wildfires weren’t a problem this year as Jackson saw the most rainfall from June to August in 25 years. Despite the weather, Park visits recovered to pre-pandemic levels and Wilson Bridge construction continued to present challenges for commuters. Jackson Hole Mountain Resort announced it’s selling but ownership will remain local and Hungry Jack’s officially reopened under its new Co-Op structure after a remodel. The Perseid meteor shower put on a show over the Tetons and August 11th marked the 125th Anniversary of the Grand Teton’s first ascent, though great controversy remains on whether the peak was summited 26 years prior in 1872.

Market Recap

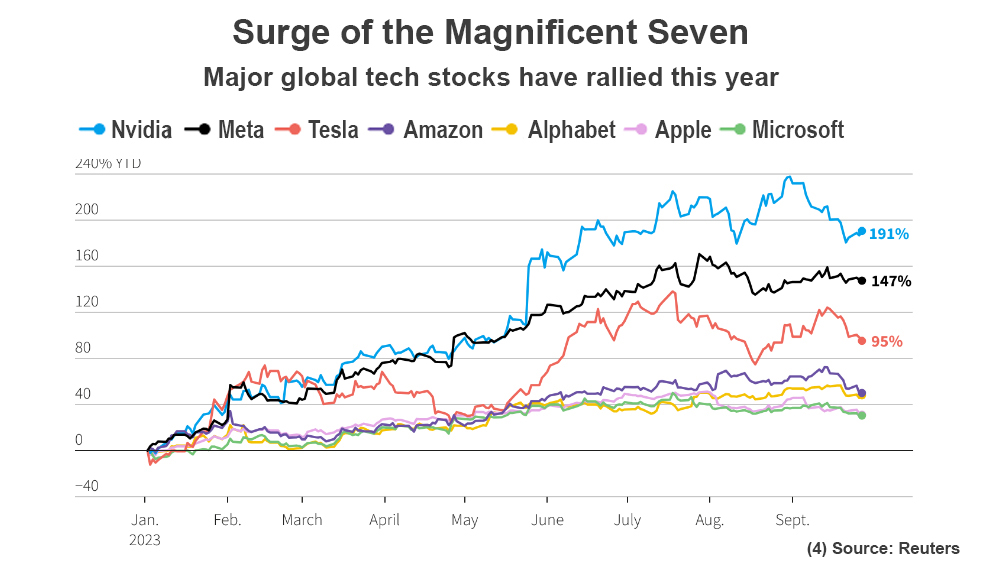

Heading into the final months of 2023, the bullish momentum that lifted equities higher in the first half of the year slowed as the Fed hinted at holding interest rates higher for longer(1). Through the third quarter the S&P 500 fell 162 points to 4288, however a strong performance from the “magnificent seven” earlier in the year helped the index maintain a positive year-to-date return of 13%. An increase in yields however sent a shock through the bond market, as the U.S. Aggregate bond index fell into negative territory for the year finishing the quarter at -1.21%(2). Keeping the Fed on its heels is a resilient economy. Consumers continue to spend and the labor market remains strong, which can prove troublesome for the Fed’s efforts to cut inflation to its 2% target. The good news overall is inflation remains in a downward trend. However, economic data through the third quarter was mixed and a spike in crude prices could translate to higher prices for consumers(3). Investors continue to question if the Fed can deliver a “soft landing” by slowing the economy and lowering inflation without putting the U.S. into a recession.

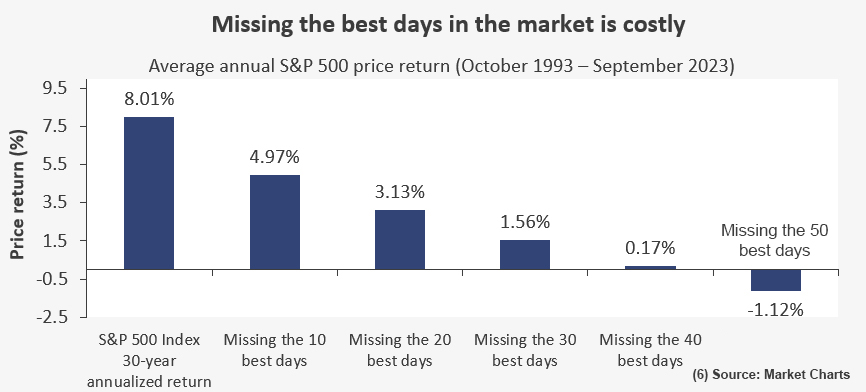

As we move into the fourth quarter, interest rates and inflation are likely to remain top of mind. Investors are anxiously awaiting the November 1st FOMC meeting where Chair Jerome Powell will provide further insight on rates. This combined with political unrest in Washington and volatile oil prices is likely to lead to continued market swings in the near term. Data is also anticipated to continue to show that the economy is slowing. The good news is current data points to a moderate slow down(5). Whether we enter a recession remains yet to be seen, but a moderating economy is good news for inflation. And as you might recall from last quarter’s newsletter, the even better news is market pullbacks have created some of the best opportunities for patient investors to grow capital(6).

Portfolio Insights

As the longest anticipated recession continues to weigh on investors’ minds, portfolio positioning and patience are as relevant as ever. While remaining invested during drawdowns can be difficult, history has shown that market timing can be costly(7). Patience can be just as important as positioning when the economy is showing signs of late cycle dynamics. We favor quality in both equity and fixed income as corporate earnings continue to face a challenging environment. For investors with equity positions in the magnificent seven, now may be a good time to take advantage of this year’s gains and reallocate some of your holdings into other investment grade securities. Historically the fourth quarter has been the best quarter of the year, and as momentum in growth stocks fade investors might benefit from repositioning to value stocks, which typically outperform growth equities during periods of high rates(8). Fixed income investors continue to face challenges in the near term but resilient investors that focus on quality are likely to benefit from higher yields over the long-term. Given the economic conditions, we also recommend investors reassess their cash positions.

We hope you enjoy a beautiful fall as we transition seasons.

Sincerely,

The Wind River Capital Management Team

**The report herein is not a complete analysis of every material fact in respect to any company, industry or security. The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice. Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

-

Q3 2023 In Review and Q4 Market Outlook. Morningstar. https://www.morningstar.com/markets/q3-2023-review-market-outlook

-

Investment Insights: Q3 2023 Market Takeaways: Wespath: https://www.wespath.org/News/Q3-2023#!/page:1

-

Stock Suffer Worst Quarter of 2023 as Good Vibes Dry Out. Forbes: https://www.forbes.com/sites/dereksaul/2023/09/29/stocks-suffer-worst-quarter-of-2023-as-good-vibes-dry-out/?sh=3493e7f83311

-

Chart 1: Surge of the Magnificent Seven: https://www.reuters.com/markets/global-markets-q3-graphic-2023-09-29/

-

Forbes Market Outlook and Forecast: https://www.forbes.com/advisor/investing/stock-market-outlook-and-forecast/

-

Chart 2: Q4 2023 Market Charts. Turing Data into Knowledge. Top chart: Dalbar, Inc., 30 years from 1993–2022; “Quantitative Analysis of Investor Behavior,” 2023, DALBAR, Inc., www.dalbar.com. Bottom chart: Bloomberg and Wells Fargo Investment Institute. Data from October 1,1993 to September 30, 2023. For illustrative purposes only. Dalbar computed the average stock fund investor return by using industry cash flow reports from the Investment Company Institute. The average stock fund return figure represents the average return for all funds listed in Lipper’s U.S. Diversified Equity fund classification model. All Dalbar returns were computed using the S&P 500 Index. The S&P 500 Index is a market capitalization weighted index composed of 500 stocks generally considered representative of the U.S. stock market. The fact that buy and hold has been a successful strategy in the past does not guarantee that it will continue to be successful in the future. The performance shown is not indicative of any particular investment. An index is unmanaged and not available for direct investment. A price index is not a total return index and does not include the reinvestment of dividends. Total returns assume reinvestment of dividends and capital gain distributions. Past performance is not a guarantee of future results. Investing in stocks involves risk and their returns and risk levels can vary depending on prevailing market and economic conditions.

-

Forbes Market Outlook and Forecast: https://www.forbes.com/advisor/investing/stock-market-outlook-and-forecast/