Q1 2022 Market Insights

Navigating Uncertainty in Early 2022

Happy spring,

We’ve been enjoying bouts of warmer temps and longer days here in Jackson as we make our way through the shoulder season. We’ve also welcomed the mix of snow and rain as drought conditions continue across the rocky mountain west. Like the weather, the market has been far from normal in 2022. Volatility has been the constant as the market works to digest the uncertainty surrounding inflation, rate hikes and geopolitics. With uncertainty likely to persist, the key for investors is to remain patient, thoughtful, and focused on the long-term while looking beyond the short-term irregularities.

Around Town

After a massive holiday storm cycle in early January, the ski season was off to a great start. The momentum however soon faded as little snow fell through the end of February. For the first time since the 1970’s, the Jackson Hole Airport closed to overhaul the entire runway. With construction crews working 24/7, the reopening is scheduled for June 28th. Spring this year brought another surprise to many local homeowners as property tax assessments increased approximately 30-50% across Teton County. In April we also dusted off our bikes and reveled in one of our favorite spring activities as we enjoyed car-free biking along the park road between Taggart Lake Trailhead and Signal Mountain.

Market Recap

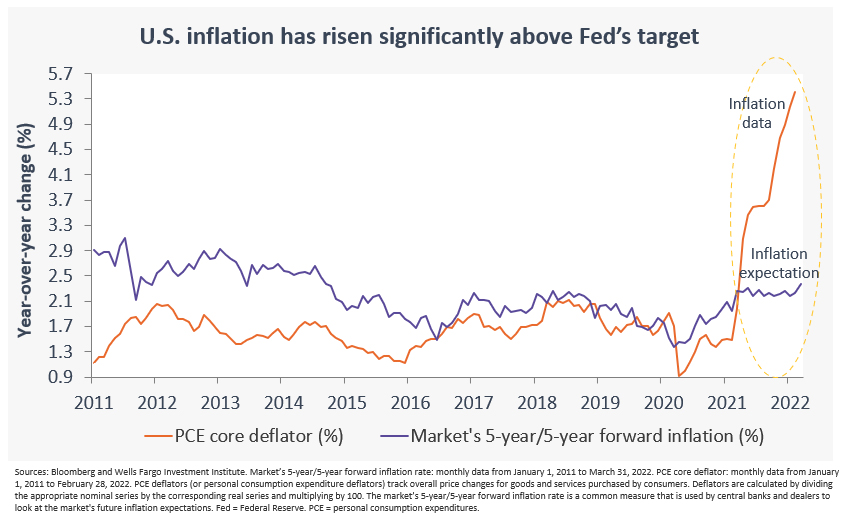

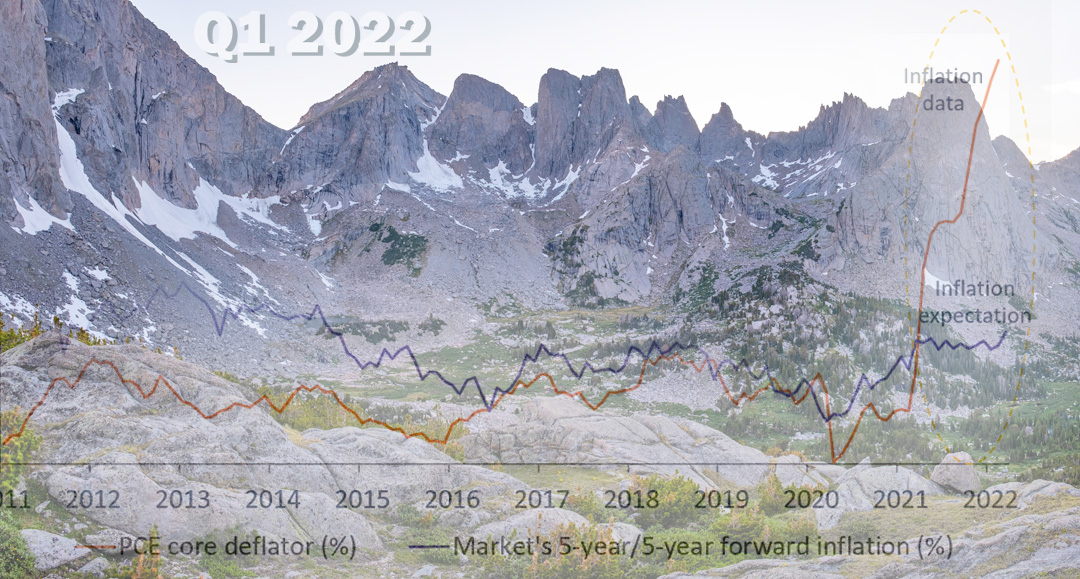

Concerns over inflation and interest rates heightened as the Fed tapered bond purchases and hinted at multiple rate increases. Strong consumer demand also added to existing price pressures. Further complicating matters, Russia invaded Ukraine on the morning of February 24th. Aside from the horrible human tragedy, the invasion rattled supply chains and pushed oil futures to over $130 a barrel. The Fed made its first 25 basis point rate hike in early March. The unwinding of easy money policy pressured equites and bonds causing 2% swings in the S&P (in either direction) more than 33 times this year, versus a total of 24 times in 2021. In April the S&P experienced its biggest monthly decline since March of 2020 to finish down 13.3% year-to-date.

Looking Ahead

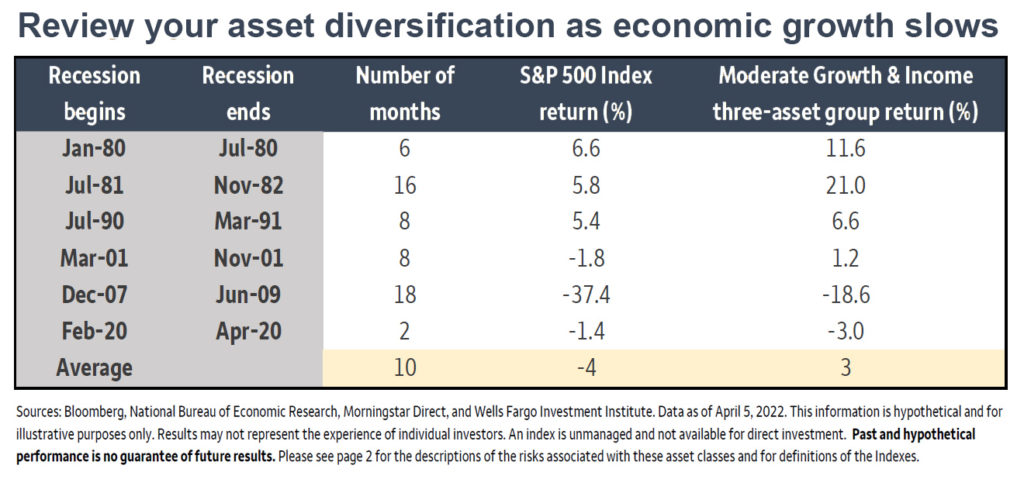

Uncertainty breeds volatility, and the market remains unsure about where inflation, rates and geopolitics go from here. However, the pandemic reminded us markets are resilient and that good temperament and strategic asset allocation can provide stability during uncertain times. Given the persistence of inflation, the Fed is likely to engage in one of its most aggressive monetary tightening campaigns in history. This is anticipated to slow the U.S. economy during the second half of 2022. The magnitude of a slowdown will depend on policy decisions, which if extreme enough could weaken a strong U.S. economy and result in a recession sometime in 2023. Global inflation will be influenced by supply chain disruptions from war in Europe and China’s Covid lockdowns. We believe these factors could lead to slowing growth and a recession in Europe in late 2022. Despite headwinds, the U.S. economy showed resilience to recent price hikes and households are in good shape as savings and net worth surged during the pandemic.

Portfolio Insights

As previously mentioned, today’s market environment requires patience, thoughtful planning, and a long-term lens. Over the past three years the market experienced many unforeseen events and it proved resilient – the S&P finished 2021 up 72% since the start of 2019. We feel it is unlikely we’ll see the growth of past years in 2022, however, in time the market will adjust to higher interest rates and moderating inflation. The length of time the market needs to settle is unknown, but investors can better position themselves for success through diversification. Diversification helps mitigate fluctuations during volatility and can help portfolios recover faster during downturns. Seeking higher quality assets that can sustain inflation, such as U.S. Large and Mid-Cap equities, and commodities may be appropriate depending on your situation. Despite high inflation, it might be prudent for some investors to maintain a cash cushion to avoid selling in a down market. Fixed Income may also still provide downside protection despite rising yields; investors should however be mindful of duration.

We hope you and your family enjoy a wonderful spring,

The Wind River Capital Management Team