Q2 2022 Market Insights

Patience with a Long-Term Focus

We hope this finds you enjoying a great start to summer! Here in Jackson, we’re happy to have sunshine and warmer temps after a cold, wet spring. Now the trails are dry, rivers are clearing up, and the valley is as green and gorgeous as ever. However, unlike the wildflowers that are beginning to bloom, the markets haven’t been as pleasant to watch. Inflation and recession fears officially pushed the S&P into bear market territory on June 13, dropping 21% from the previous high seen on January 3, 2022(1). Market uncertainty is likely to persist until inflation moderates, which means investors should remain patient and keep a long-term focus when reviewing portfolios.

Around Town

After the ski resorts closed in early April, winter decided to come back as 78” fell in Rendezvous Bowl by the end of the month. Over Memorial Day weekend, we saw a foot of snow above 9,000 ft. In June, Yellowstone experienced historic flooding, and a supercell thunderstorm passed north of town. With the airport reopened and summertime events from Slow Food in the Tetons in full swing, town is full of energy and things to do. The rec center is getting a face lift, Search & Rescue is staying busy, and the Town Council recently approved a $39.6M budget for 2023.

Market Recap

There is no sugar-coating it, the first half of 2022 was a tough one for the market. Finishing 21% down on June 30, 2022 at 3785.38, the S&P posted its worst first half of the year since 1970(2). Bonds(3) lost 11%, posting their worse start to a year in history. Commodities, however, rose as prices for oil, metals and grains surged. Inflation remains the primary driver of market disruption. Through the end of May, the Consumer Price Index (CPI), which measures the average cost of a consumer goods, had increased 8.6% over the past 12-months. This prompted the Federal Reserve to raise interest rates 75 bps (0.75%), slightly higher than the market anticipated.

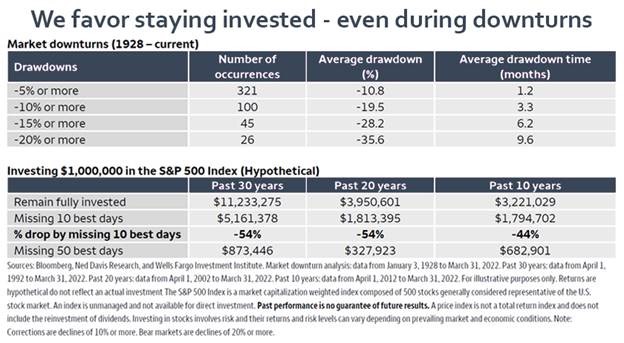

Inflation and the Federal Reserve’s monetary policy are likely to drive continued volatility in the market. Uncertainty overseas between Russia and Ukraine, as well as mending supply chains, could add additional stress. The economy is showing signs of slowing and consumer sentiment, which measures how consumers feel about the economy and their personal finances, is near record lows. A U.S. recession is possible if the economy continues to contract, however, if certain sectors like the U.S. job market remain strong, it is likely to be short and mild. Given the current late cycle dynamics, a slow down or recession is not uncommon. Since 1928, the market has experienced 26 drawdowns of 20% or more that lasted an average of 10-12 months(4). After each bear market however, markets have historically experienced strong performance, further emphasizing the importance of remaining invested.

Portfolio Insights

We believe maintaining a balanced, all-weather portfolio makes sense in any market environment, but it’s particularly relevant in this one. For equities, investors should continue to focus on high-quality U.S. Large-cap and Mid-cap securities, while reviewing exposure to cyclical holdings as the economy slows. For investors seeking yield, global dividend payments rose 20% year-over-year(5). Dividend-paying stocks can offer favorable yields and stability during times of volatility, however, they are not guaranteed and can change with market conditions. Fixed income is also becoming more attractive as yields have risen and bond prices have adjusted to the Fed’s pace of rate increases. Fixed income can also still provide downside protection; however, investors should be mindful of duration. For some investors, it might be prudent to take advantage of bear market rallies in order to maintain an appropriate cash cushion to cover expenses.

If you’re interested in diving deeper into what the remainder of the year could look like please give us a call at your convenience.

Sincerely,

The Wind River Capital Management Team

**The opinions expressed here reflect the judgment of the author as of the date of the report and are subject to change without notice. Any market prices are only indications of market values and are subject to change. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Additional information is available upon request.

-

The Wall Street Journal https://www.wsj.com/articles/global-stocks-markets-dow-update-06-30-2022-11656487667-11656574533

-

The Wall Street Journal https://www.wsj.com/articles/global-stocks-markets-dow-update-06-30-2022-11656487667-11656574533

-

The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

-

Please reference the “We favor staying invested – even during downturns” chart

-

The Capital Group 2022 Midyear Outlook https://www.capitalgroup.com/advisor/insights/categories/outlook.html?sfid=1282066894&cid=80773477&et_cid=80773477&cgsrc=SFMC&alias=C-btn-LP-4-cta1