Q3 2022 Market Insights

Patience is a Tough Virtue

Summer stuck around a little longer here in Jackson as we enjoyed a gorgeous start to fall. It was a warm few months, but August rain kept wildfire smoke at bay and painted the valley in an array of colors as wildflowers bloomed in abundance. Now, hues of golden yellow cover the peaks and valleys as the Aspens embrace the changing seasons. The markets however remain reluctant to embrace change as the economy slows and inflation persists. The S&P fell for the third quarter in a row as rising interest rates continued to pressure equities. We believe volatility is likely to remain until inflation wanes, which means investors should remain composed and focused on long-term goals.

Around town

It often feels too short, but summer in Jackson is hard to beat. The Hootenanny was in full swing at Dornan’s and Snow King debuted a new concert series on the town hill summit. We enjoyed fresh produce from local markets and welcomed the County Fair’s full return after two years of Covid-related modifications; 4-H participants even set new auction records. Grand Teton National Park Foundation celebrated 25 years and Old Bill’s Fun Run was back in-person and seemed bigger than ever. The new downtown Fire Station also officially opened and this year’s SPET ballot is full of so many initiatives it has its own website.

Market Recap

Inflation and interest rates continued to roil markets through the third quarter. After entering bear market territory in mid-June, the S&P staged a sharp recovery to start the second half of the year. The almost 19% rally was short lived as momentum faded mid-August. Inflation persisted into September and the jobs market remained strong prompting the Federal Reserve (Fed) to raise interest rates another 75 basis points (0.75%). This combined with geopolitical strains, a strong dollar and recession concerns amplified market volatility causing yields to rise and risk assets to fall. The S&P finished the quarter at 3585.62, down almost 25% for the year, and the 10-year treasury climbed above 4% for the first time in over a decade.

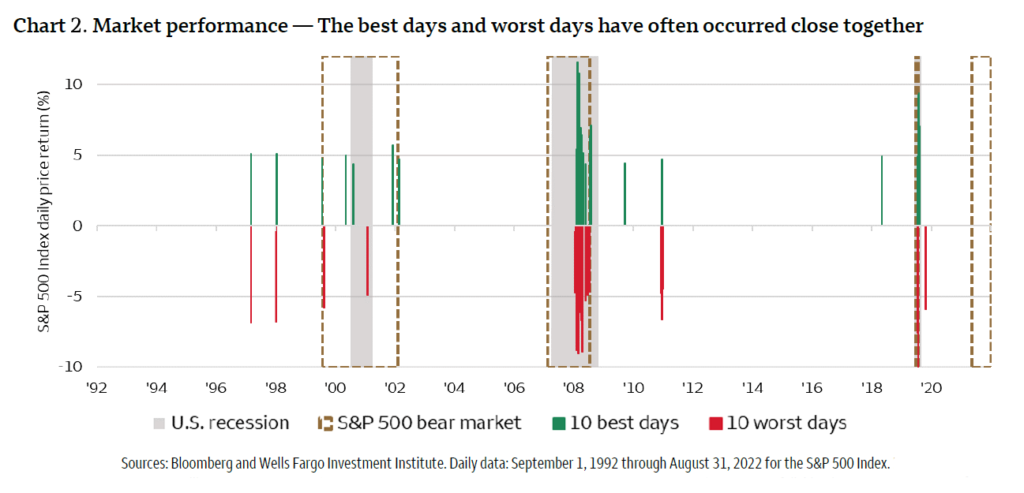

So, what’s next and when will markets bottom? The U.S. economy has experienced back-to-back quarters of declining gross domestic product – a technical recession(1). However, we feel a strong labor market has likely pushed off the start of a moderate recession to late 2022. The Fed is anticipated to remain hawkish, unless economic data convinces them otherwise, and Europe is facing recessionary headwinds(2). As investors, we think it is helpful to look at history and realize that at some point inflation will ease, markets will stabilize and the Fed will be finished hiking rates. While these things won’t likely happen tomorrow or next week, markets tend to be forward looking and could be pricing much of the bad news we expect to hear in coming months. This is not to say stocks have bottomed and rates won’t go higher, but, eventually, we believe brighter skies will be on the horizon.

Portfolio Insights

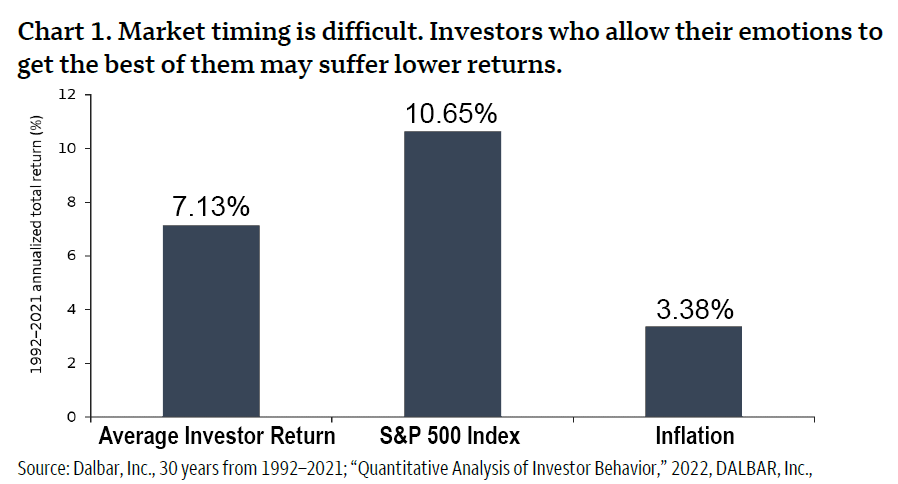

For many investors, we feel there is a time for calculated risk taking, and a time for patience. This year has taxed the patience of many investors, as almost every asset class, besides commodities, the U.S. dollar and cash, has experienced negative returns. Warren Buffett said it best – “the stock market is a device for transferring money from the impatient to the patient.” We advise investors to take a deep breath and have confidence in your investment plan. Maintain a balanced, diversified portfolio and focus on quality. If you have a long-term investment horizon, a dollar-cost averaging approach could be a good way to put cash to work while markets are down. If you have a shorter horizon, or want to take a more defensive approach, consider U.S. short-term fixed income to take advantage of higher yields. Patience is a tough virtue, but for investors it can be one of the most rewarding.

If you’re interested in diving deeper into how recent policy changes could affect markets in the coming months we invite you to read our most recent strategic guidance report by clicking HERE. We wish you and your family a happy fall.

Sincerely,

The Wind River Capital Management Team